The current economic situation in Hamblen County, strategic challenges in the economic downturn and understanding new credit card legislation were key topics of an Economic Summit held in Morristown on Thursday.

The event was sponsored by Tusculum College and Lowland Credit Union in order to help local citizens get answers to financial questions in the context of the current economic turndown.

“We are pleased to have this opportunity to provide answers for our members and the community, said Mark Creech, chief executive officer for Lowland Credit Union. “And, we are very pleased to partner with Tusculum College to provide this event.”

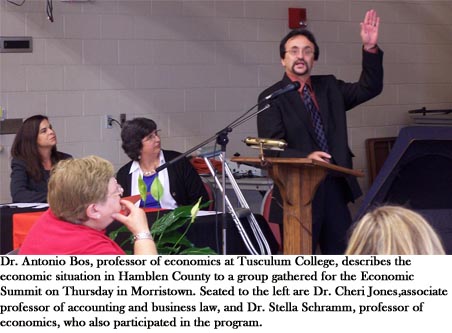

Dr. Antonio Bos, professor of economics at the College, provided statistical information that showed why Hamblen County is specifically more vulnerable to an economic turndown or recession.

The high number of manufacturing jobs – one in three jobs in the county is a manufacturing job – and specifically automotive part and furniture manufacturing results in a higher sensitivity to a recession, said Bos.

“The overwhelming number of jobs are highly affected by a recession,” he told the group. “You can expect that whenever there is a recession, Hamblen County will be affected more.”

Dr. Stella Schramm, professor of economics at Tusculum College, addressed the issue of how businesses and individuals can strategically prepare for the future. The group was told about consolidation during times of high competition which a recession can produce.

“With the same number of companies competing for fewer buyers, some will fall out of the market,” she said. “This will often result in consolidation, and some companies will come out of the recession stronger.”

She added that skill development for individuals and job seekers is extremely important during a down market, adding widely applicable skills that could apply to a variety of job sectors is a good strategy as the job market settles.

Dr. Cheri Jones, Tusculum College associate professor of accounting and business law, reviewed the Credit Card Act of 2009.

“More than 80 percent of Americans have a credit card with a balance. If you do not, you know someone who does,” said Jones.

With the new legislation, which affects only consumer credit cards, credit card companies must be more responsible with rate increase and fees and must be clear and open in communication with card holders about any changes being made.

Several key items included a mandatory 45-day notice of any rate increase, the prohibition of retroactive interest rate increases, the elimination of double cycle billing and reduction in over-the-limit fees.

“Credit card companies will be forced to provide clear disclosure,” said Jones. “They will be required to provide on each statement how long it would take to pay off the current account balance if only the minimum amount due is paid and the interest amount that would be accrued.”

She advised the group that several economic scams have proliferated during the economic turndown and warned them to beware of any job offer, credit service or other activity that asked for personal account information or a payment upfront. She advised everyone to check out a questionable offers or emails with either the Better Business Bureau or the Federal Trade Commission.