GREENEVILLE – If you seek free assistance preparing your 2021 tax return, Tusculum University has the perfect solution.

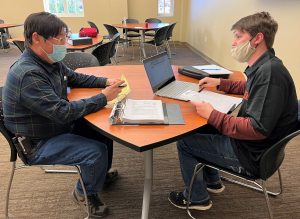

Ben Gall, right, a junior at Tusculum, who is pursuing a major in accounting, practices preparing a tax return.

Tusculum is participating again in the Volunteer Income Tax Assistance program and meeting clients in Rooms 001 and 005 of the Meen Center on the Greeneville campus as well as locations in Washington County during February, March and April. The off-campus facilities are at Westminster Presbyterian Church, 2343 Knob Creek Road, Johnson City, and the Washington County Library, 200 E. Sabine Drive, Jonesborough. The library is a new location this year.

“We are pleased to offer this free service to the community as part of our university’s commitment to civic engagement,” said Dr. Harold Branstrator, an associate professor of management at the university and a former Internal Revenue Service revenue agent and current IRS enrolled agent. “Filing tax returns can be a daunting task for some people, and we welcome the opportunity to make that process easier for them, all with a smile from a friendly face.”

Among those who might qualify for this help are:

- People who generally earn less than $59,000 a year

- Anyone older than 65

- People with disabilities

- Limited-English-speaking taxpayers

Tusculum students and community volunteers, trained by Dr. Branstrator, provide customized service for each person. The IRS certifies the preparers. Funding the initiative are the IRS; Truist; Westminster; and Blackburn, Childers & Steagall.

Appointments are available Mondays at Westminster Feb. 7, Feb. 14, Feb. 28, March 14, March 21, March 28, April 4 and April 11. The first appointment is at 5 p.m., and tax preparers conclude at 10 p.m.

Tax preparers serve clients Thursdays on the Tusculum campus with the same hours Feb. 10, Feb. 17, Feb. 24, March 3, March 17, March 24, March 31 and April 7.

Clients can receive assistance Saturdays at the library from 9 a.m.-2 p.m., with available dates of Feb. 12, Feb. 19, Feb. 26, March 19, March 26, April 2 and April 9.

Appointments last about 45 minutes, but more time is available, if necessary. All appointments are in-person, but preparers will take all safety precautions to reduce the potential for spread of the coronavirus. Clients should bring a face covering in case the facility requires one.

Participants should bring their W-2 and 1099 forms, dividend and interest statements, tax documents related to their small business or rental property and any other items required for a complete filing.

To schedule an appointment, please call Dr. Branstrator at 423-636-7414 or register online at https://bit.ly/3fOyDqc. Interested community members can also visit https://web.tusculum.edu/vita/ for more information.

Anyone who is interested in volunteering to prepare tax returns for clients in Tusculum’s VITA program should call Branstrator.

“This is one of our favorite outreach programs because it not only provides valuable assistance to the community but also demonstrates the quality and skill of our students who participate in this initiative under Dr. Branstrator’s expert guidance,” said Dr. Jacob Fait, dean of Tusculum’s College of Business. “VITA is an outstanding opportunity for these students to show they are becoming career-ready professionals. We are also grateful to the organizations that provide the financial resources to make this endeavor possible.”

Further information about the university is available at www.tusculum.edu.