GREENEVILLE – East Tennessee residents who would like free assistance with their income tax return preparation can once again turn to Tusculum University.

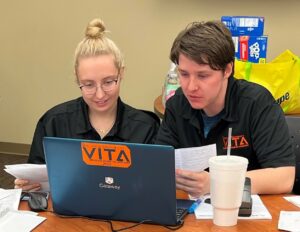

Ben Gall, right, and Taylor Miles work on a client’s income tax return in 2022 as part of the VITA program.

The higher education institution is participating in the Volunteer Income Tax Assistance program for the seventh consecutive year. Fifteen students and seven community volunteers, all trained by Dr. Harold Branstrator, a former Internal Revenue Service revenue agent and current IRS enrolled agent, will be available from Feb. 6-April 13 to assist clients with their income tax return. The IRS certifies the preparers.

The days, times and locations for tax return preparation are:

- Mondays, 5:30-8:30 p.m., Westminster Presbyterian Church, 2343 Knob Creek Road, Johnson City

- Thursdays, 5:30-8:30 p.m., Meen Center Rooms 001 and 005 on Tusculum’s campus in Greeneville

- Saturdays, 10 a.m.-2 p.m., Washington County Library, 200 E. Sabine Drive, Jonesborough

“We are delighted to minimize the stress for taxpayers by offering this beneficial service to the community as part of the university’s commitment to civic engagement,” said Dr. Branstrator, who also serves as an associate professor of management at Tusculum. “Our team is well-prepared and welcomes the opportunity to help people achieve a successful outcome. VITA is also an excellent method to provide our students with active and experiential learning, which equips them to be career-ready professionals. We are grateful to Westminster for its financial support and to the IRS, Truist and Ballad Health for providing grants to assist us.”

Appointments take place in person and last about 45 minutes, but more time is available, if necessary. Clients should bring their W-2 and 1099 forms, dividend and interest statements, tax documents related to their small business or rental property and any other items required for a complete filing.

Among those who might qualify for the program are:

- People who generally earn $60,000 or less a year

- Anyone older than 65

- People with disabilities

- Limited-English-speaking taxpayers

To schedule an appointment for tax return preparation services, please visit https://www.signupgenius.com/go/tuvita2023 or call Dr. Branstrator at 423-636-7414. Additional information about the program is available at https://web.tusculum.edu/vita/.

Meet Tusculum student Ben Gall

Many of the students who are tax return preparers have participated in the VITA program for several years. One is senior Ben Gall, who is on track to graduate in May with a bachelor’s degree in accounting. In addition to taking classes for his degree and participating in VITA, Gall is interning with the Blackburn, Childers and Steagall accounting firm.

“I’d say I definitely received the internship because of my work with VITA,” he said. “This will be my fourth year with VITA, and it has given me the experience to really succeed in this field and to stand out as a candidate and be hired as an intern at this firm. It has also guided me down a career path that I have found interests me very much.”

Based on his experience with VITA, Gall has chosen to pursue licensure as an enrolled agent with the IRS. That status, which he hopes to achieve by the spring, will give him the most highly recognized tax professional certification available in the United States, he said. It essentially will give him limited attorney power for tax matters and to represent a client in front of the IRS.

Gall will be able to carry that status with him were he to move to another state. Serving as an enrolled agent helped him obtain his internship and will empower him to excel and exceed expectations as he seeks a career in the tax profession field, he said.

“I enjoy working in the tax field because it is a very intimate and personal profession where you really get to help people in a way that not a lot of other positions can,” Gall said.

Meet Tusculum student Aaron Couch

Senior Aaron Couch, who is double majoring in management and accounting, will participate in VITA for the second year during this tax season. He is also seeking certification as an enrolled agent and plans to achieve that status by May. He was inspired to participate in VITA after learning about it in Dr. Branstrator’s organizational management class.

“Dr. Branstrator was always talking about VITA and how he had been an IRS agent and the way that position opened up a lot of career paths,” Couch said. “So I decided to join the VITA program, and through that, I learned about being an enrolled agent. That sounded like a certification I would like because I became interested in focusing on the tax side of accounting after working with VITA. I like the possibility of helping others to save money on their taxes and plan for it in the future.”

Couch’s eventual goal is to become a certified public accountant and work on taxes. He interned during the summer for an insurance agency in Johnson City, where he performed worker’s compensation audits. His experience with VITA was a factor in obtaining that internship, he said.

“VITA has helped me learn that I like to work with the community and give back to the low-income earners,” said Couch, who is graduating in May. “It has also provided me with the knowledge of a career path that I feel like would best suit me. It has given me interpersonal skills because you interact with people and try to understand what their situation is as far as taxes.”

Meet Tusculum student Dakota Hammonds

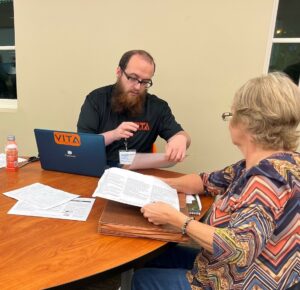

Dakota Hammonds, left, works on a tax return with a client in 2022.

Senior Dakota Hammonds, who is participating in VITA for the second year while he completes his bachelor’s degree in criminal justice, has different career goals. He became involved in VITA through Justice Upp, a fellow Tusculum student, who recommended the program. His game plan is to go to law school and practice criminal law, but his backup plan is to practice tax law.

“I started VITA mainly to figure out how to do my own taxes, and then I stayed because of Dr. Branstrator and the fact that I enjoyed doing tax return preparation as a way to give back to the community,” Hammonds said. “VITA looks very good on law school applications because a lot of law schools require some community service and most law schools already have a VITA clinic. I’m more knowledgeable about taxes now and am able to do my own taxes, and I’m able to help people who don’t understand how to do it and save them money.”

Other students who have participated in VITA and have graduated have landed excellent jobs at places such as accounting firms, banks and credit unions, Dr. Branstrator said. He said banks, credit unions, accounting firms and tax preparation facilities find individuals with that background to be desirable hires.

More information about the university is available at www.tusculum.edu.